The recent statewide poll released by the Detroit Regional Chamber has significant contrasts and causes for concern for anyone who cares about the future of automotive and mobility in Michigan.

It shows that voters want our state to compete for the industry, but those aspirations are under cut by many residents’ negative views of EVs and an unwillingness to embrace the technological change that is reshaping our signature industry.

While it is encouraging to note that 76% of Michigan voters support developing an advanced economy in Michigan, and 60% believe it is important to beat China in the EV market – the overall politicization and polarization reflected in the poll is a direct threat to Michigan’s ability to lead this industry in the future.

Overall – the overarching takeaway from the poll is that we need to rally the state around our automotive and mobility industry and embrace the change that is coming. Below are several other insights worth noting.

EVs Are Coming, Michigan Will Make Them or Fade

Voters are split nearly 50-50 on whether electric vehicle sales will increase significantly in the next 10 years despite the fact EVs had a 9.3% market share in the U.S. in 2023, compared to 2.3% in 2020. While the pace of adoption has led to slower growth, the fact is that electric vehicle sales will continue to increase over time. Michigan’s 12 assembly plants will either produce the products that the market demands into the future, or they will not exist, and automotive jobs will disappear with them.

Voters are split nearly 50-50 on whether electric vehicle sales will increase significantly in the next 10 years despite the fact EVs had a 9.3% market share in the U.S. in 2023, compared to 2.3% in 2020. While the pace of adoption has led to slower growth, the fact is that electric vehicle sales will continue to increase over time. Michigan’s 12 assembly plants will either produce the products that the market demands into the future, or they will not exist, and automotive jobs will disappear with them.

Until We Develop Our Own, The EV Supply Chain Must Include China and Other Countries

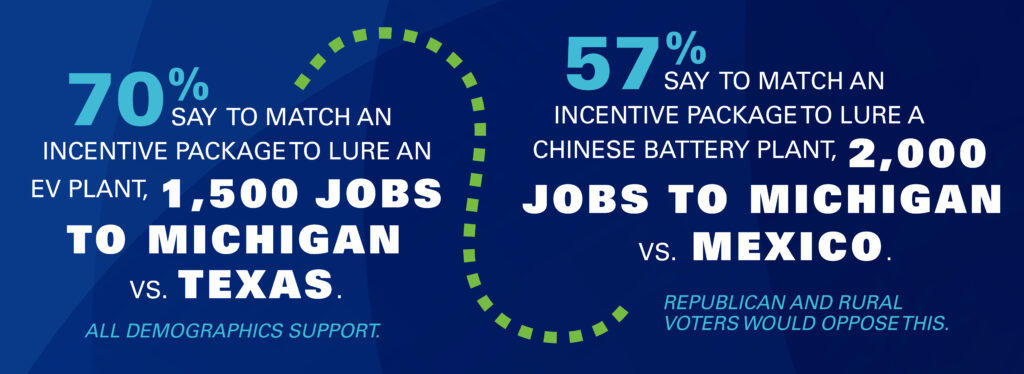

Per the poll, 70% of Michigan voters support matching offers to beat out Texas for an EV battery plant. That support drops to 56.9% when posed with the hypothetical of attracting a Chinese plant that would otherwise be heading to Mexico. Furthermore, support for competing to beat China in the EV market was split across party lines.

Over time there will be the opportunity for more electric vehicles to be made in Michigan. But this will require that the supply chain for battery components exist here. That supply chain, like much of Michigan’s diverse international supply chain, will need to include suppliers from China, Korea, and Japan. This is where the majority of suppliers exist in today’s global EV component supply chain – and that’s a reality that needs to be embraced, and not politicized.

Maintaining Our Automotive Leadership Means Leading in Battery Technology

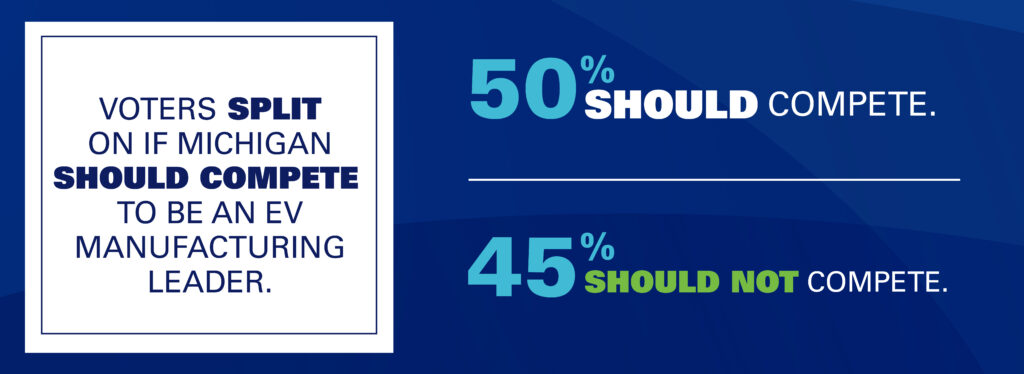

Voters are also not aligned as to whether Michigan should compete aggressively to be the leader of EV manufacturing. Only a narrow majority (50.3%) support Michigan competing to be a leader in EV manufacturing, while 44.9% of voters believe Michigan should not compete.

This is extremely concerning. Our state is a global epicenter for automotive manufacturing and innovation. To maintain our leadership role as the industry transitions, it will be critical that we lead in the development of new battery technology and that our supplier and assembly plants transition as well.

Tech Talent Is Key to Electrification – and Those Skills Require Higher Education

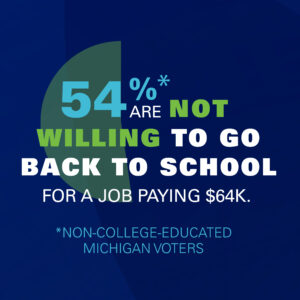

Michigan is going to need more technical talent as electrification and digitalization increase in the industry. However, according to the poll, approximately 54% of non-college voters in the workforce are not willing to pursue additional schooling for jobs that require four years of college or other advanced attainment.

Michigan is going to need more technical talent as electrification and digitalization increase in the industry. However, according to the poll, approximately 54% of non-college voters in the workforce are not willing to pursue additional schooling for jobs that require four years of college or other advanced attainment.

With Michigan’s population growth and workforce aging challenges, non-college adults returning to school must be part of any successful strategy in building the future workforce we need. Michiganders must be willing to develop and learn skills and have a desire to compete on a global basis if we are going to continue to be the center of automotive innovation.

In Conclusion: EV Politicization Is Threatening Michigan’s Potential to Lead and Grow

Heading into the election, EVs and the supporting supply chains are being politicized at the expense of Michigan’s potential to lead and grow in this industry transition. Division is being created in geographic areas of the state that need good jobs.

We have already seen significant shifts in manufacturing to the Southeast and Mexico over the past several decades. And prior to that, the 1970s served as opportunity lost for Michigan as it downplayed the threat from international competitors and failed to deliver the fuel efficiency and vehicle quality global market forces were moving toward. These lessons can be applied to today’s inflection moment.

Surrendering more advanced manufacturing to other regions or countries because we are not supporting new EV technology growth is something we must all work together to combat.